A statement conveying whether or not the charitable contribution was produced by the use of a bargain sale and, In that case, the level of any thought obtained for your contribution.

when you volunteer for an experienced organization, the following concerns and responses may utilize for you. the entire guidelines explained Within this publication also use. See, in particular,

Tuition, or amounts you pay instead of tuition. You cannot deduct for a charitable contribution amounts you shell out as tuition even if you pay back them for kids to show up at parochial colleges or qualifying nonprofit daycare centers.

You don't lead the rest of your pursuits from the property to the original recipient or, if it no longer exists, A different experienced Firm on or ahead of the sooner of:

Donor-recommended money. If you need a tax split now but prefer to unfold your donations after some time, you could give to a donor-advised fund. You make an irrevocable gift in to the fund that you can’t get again. you are able to deduct the whole transfer upfront (approximately fifty% within your AGI) if donating income, or thirty% if donating appreciating securities.

in case you declare a deduction of not less than $250 but not in excess of $500 to get a noncash charitable contribution, you will need to get and continue to keep a contemporaneous published acknowledgment of the contribution within the certified organization.

Any allowable deduction for interest you paid out (or will pay) to buy or have the bond which is attributable to any period of time prior to the contribution; or

Your foundation in property is normally what you paid for it. If you need additional information about foundation, see Pub. 551, Basis of Assets. you might want to see Pub. 551 in the event you contribute residence which you:

A Qualified historic composition is a creating that's stated separately in the National sign up of Historic Places (National sign up constructing) or maybe a developing that is situated inside of a registered historic Solutions district and has long been certified from the Secretary of the inside as contributing to the historic importance of that district (historically considerable developing).

If the expense of donated stock just isn't A part of your opening inventory, the stock's basis is zero and you can't declare a charitable contribution deduction.

This option applies to all money achieve house contributed to 50% Restrict corporations throughout a tax year. Furthermore, it applies to carryovers of this type of contribution from an before tax yr. For facts, see

Contributions to your school or College if the quantity paid out is always to (or for your benefit of) a college or university or College in Trade for tickets (or the correct to buy tickets) to an athletic event in an athletic stadium of the school or College.

when you situation and supply a promissory note to some charity as a contribution, it is not a contribution until finally you make the Notice payments.

, earlier.) retain the assertion to your documents. it might satisfy all or Element of the recordkeeping prerequisites defined in the next conversations.

Ben Savage Then & Now!

Ben Savage Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Shannon Elizabeth Then & Now!

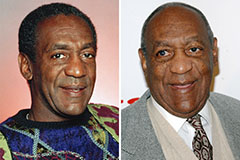

Shannon Elizabeth Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!